Did you know flooding is not covered under your regular homeowners insurance policy?

Take these steps to learn more about flooding. Don't let the water win.

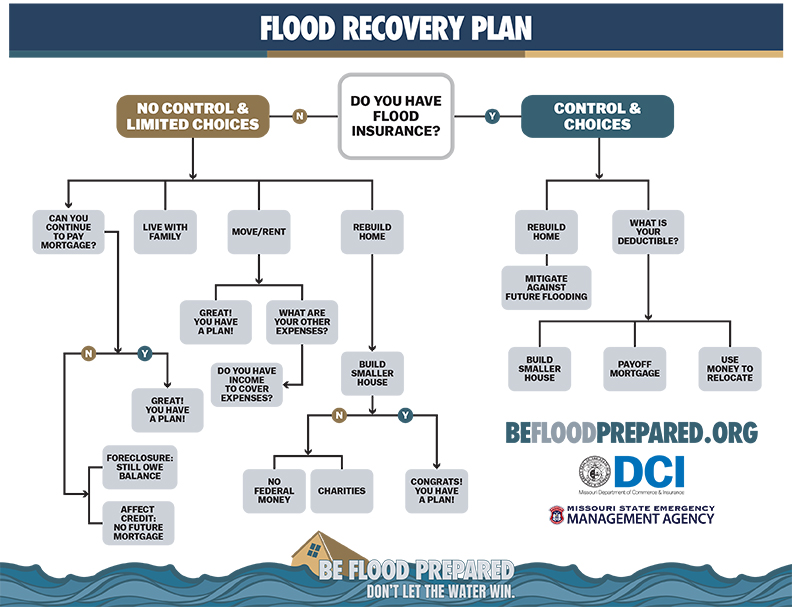

If a major flooding event happens, are you prepared?

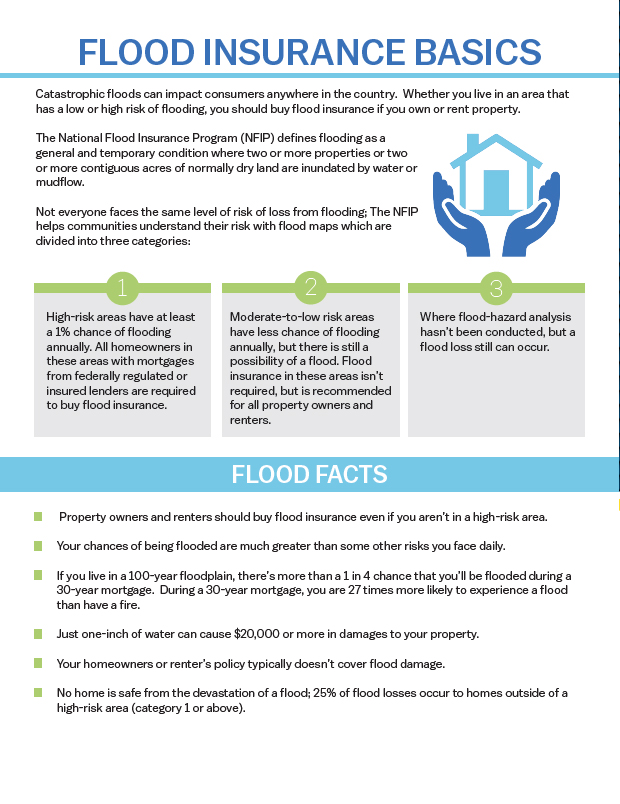

Flooding is the most frequent and expensive natural disaster in the United States. Yet, most homeowners and renters insurance policies do not typically cover flooding.

Just because you don't live in a high-risk flood area doesn't mean you don't need flood insurance. If it rains where you live or do business, it can flood. With over 20 percent of the National Flood Insurance Program's (NFIP) claims coming from outside high-risk flood areas, those who live in areas with low-to-moderate flooding risk should understand their risk and consider flood insurance.

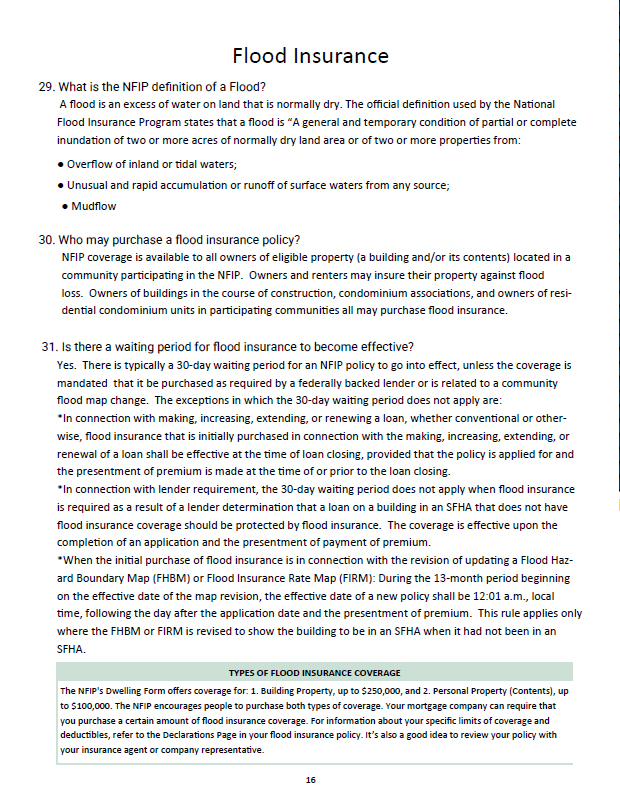

Don't delay buying flood insurance. Most flood policies require a 30-day waiting period before they go into effect. According to the Federal Emergency Management Agency, just one inch of water can cause up to $25,000 in damage.